Record highs and strong demand fuel cattle market surge

Posted on January 8, 2025 by Trey Freeman

Source: Farm Progress. The original article is posted here.

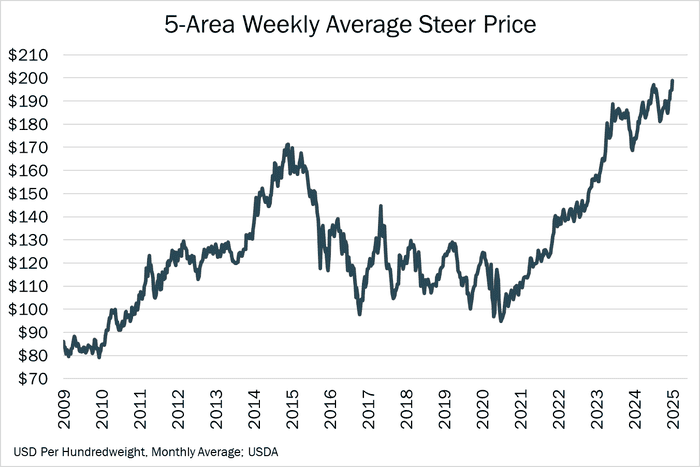

After the holiday lull, the CME Feeder Index printed a new record all-time high of $265.76 per hundredweight, feeder auctions across the country picked up steam once again.

The strong market for fed cattle boosted live and feeder cattle futures Thursday, resulting in triple-digit gains for both commodities. The strength carried over into early Friday morning before softening into the close. For the week, February live cattle finished with gains of $3.40 per hundredweight and March feeder cattle with gains of $3.625 per hundredweight. Live and feeder cattle posted record-high prices for a nearby contract last week.

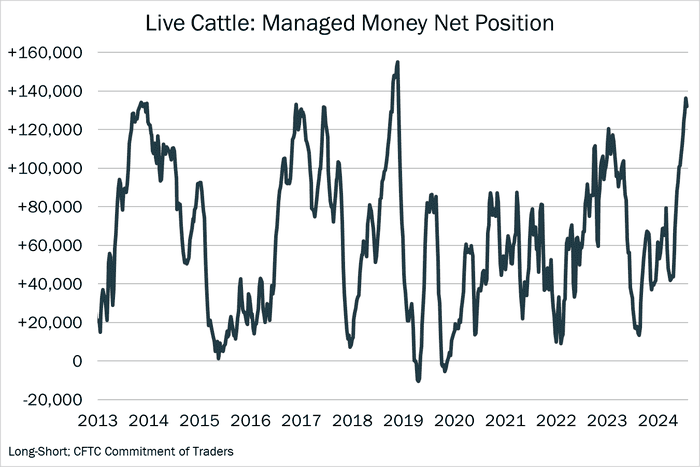

Open interest in live cattle surged last week to 365,724, up 23,100 contracts on the week, its highest level since March of 2023, indicating length being added by managed money. Open interest is bumping up against levels that it has had a hard time surpassing in recent years. The same goes for the length of managed money.

Related: 200 weeks and counting

Boxed beef prices remain firm with choice up $2.86 per hundredweight last week at $325.24. In the last full week of December, choice beef averaged $319.58 per hundredweight. This was over $28 per hundredweight higher compared to the same week last year. Choice averaged nearly $24 per hundredweight more in December of 2024 compared to December of 2023.

Even with higher wholesale and retail prices, consumer demand for beef looked strong over the holiday period. Persons familiar with scanner data say that beef volume sales at retail increased by more than 5% year-over-year from November 1 through year-end, easily surpassing pork and chicken sales growth. For all of 2024, volume sales by this same measure gained more than 3% versus 2023 even with prices up by an average of 5%. While at some point price always matters, Americans continue to demonstrate that they love eating beef.

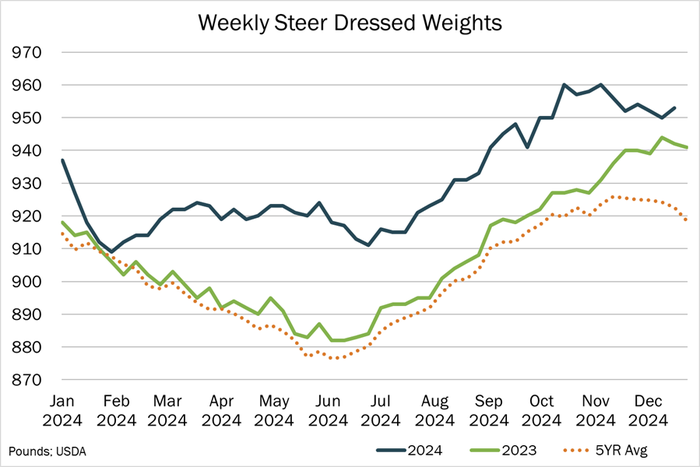

Beyond strong overall demand dynamics, boxed beef performance in 2024 merits a couple of observations. First, choice beef averaged $9.45 per hundredweight more than 2023 for the year, or +3.2%. This was impressive considering fed beef production outpaced last year by approximately 2.2% because of record large carcass weights, signaling strong demand for beef.

Related: Weather Update: January 7, 2025

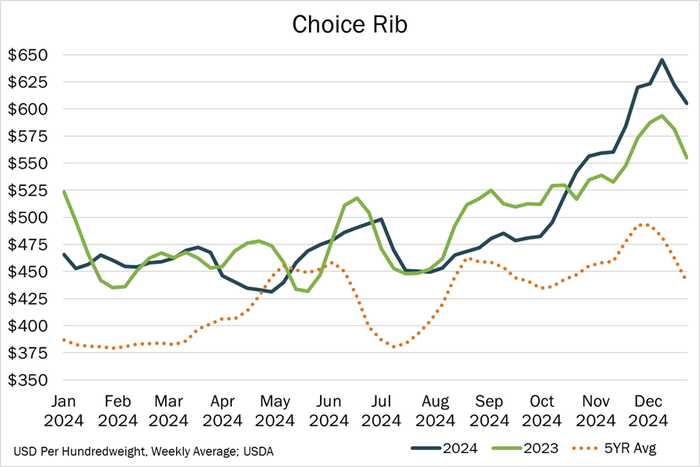

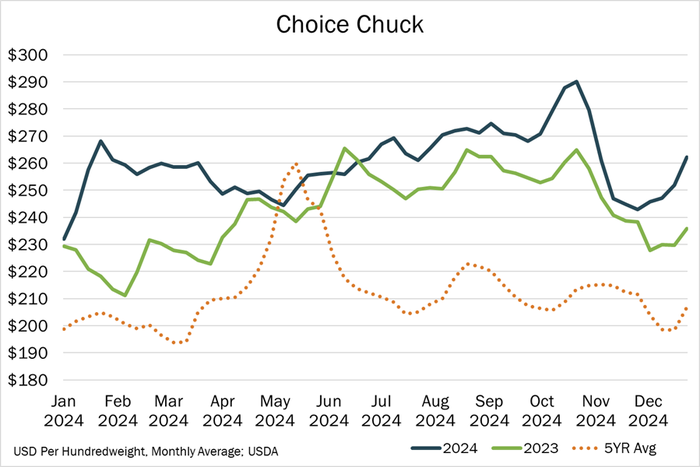

Second, demand for end meats played a greater role in the overall strength of boxed beef prices while the middles, mostly the rib, failed to sustain higher prices for the full year. Choice chuck averaged $259.52 per hundredweight for the year, or 7.1% more than in 2023. The choice round averaged $258.17 per hundredweight, or 10.1% more than in 2023. Choice rib primal averaged 1.2% less than in 2023, averaging $489.11 per hundredweight.

Slaughter data released Thursday for the week ending December 21 showed a three-pound increase in dressed steer weights from the week prior, up to 953 pounds. Dressed heifer weights were reported five pounds higher from the week prior at 871 pounds, a new record for heifers. This is likely to continue as cattle feeders have an economic incentive to add days on feed. Record dressed weights have undoubtedly suppressed fed cattle prices to a degree. However, this “give” has so far outweighed the “take” – no pun intended.

With fed cattle supplies to seasonally increase over the next few weeks and a seasonal tendency for boxed beef to trade in a sideways manner, a softer tone is likely to develop in the cash markets for fed cattle lasting into February. As for futures, managed money holds a hefty net long position, posing the risk of long liquidation should they lighten their load.

Related: Will the new Trump administration expand opportunities for U.S. red meat exports?

The risk of loss trading commodity futures and options can be substantial. Investors should carefully consider the inherent risks in light of their financial condition. The information contained herein has been obtained from sources to be reliable, however, no independent verification has been made. The information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended to be a solicitation. Past performance is not indicative of future results.

.jpg?disable=upscale&width=1200&height=630&fit=crop)