200 weeks and counting

Posted on January 8, 2025 by Nevil Speer

Source: Farm Progress. The original article is posted here.

Year In Review

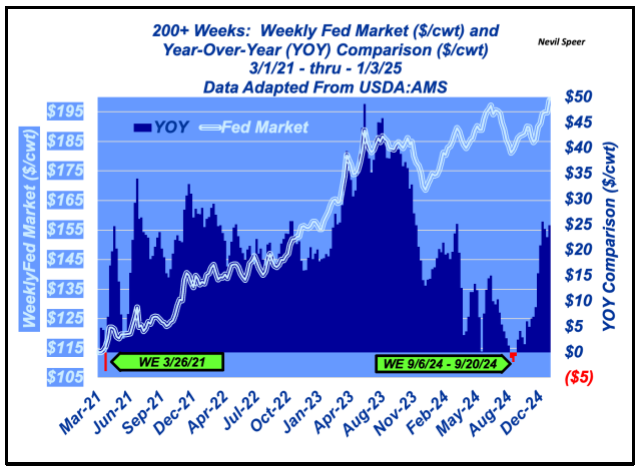

Most producers are generally feeling (very) positive about the business. That’s not surprising given what happened in the markets in 2024 (and 2025 has started with a new all-time high). The fed market averaged $187 for the year –up ~$11/cwt versus 2023. Meanwhile, the CME feeder cattle index averaged ~$250 for the year and even managed to eclipse $260 in December.

But none of that is new; rather, it’s just a continuation of the longer-run trend. What is surprising, though, is the duration of this market’s bull run.

Quick Review

Recall the fed market bottomed in July 2020 at $95 – but then chopped its way to $110 by the end of January 2021. Producer sentiment at the time was understandably pessimistic; it was a very challenging stretch. During that time, I consistently received emails from producers sharing their frustration about the market’s weakness (and packer profits).

But even amidst that bearishness, the market was signaling some light at the end of the tunnel. And that really began in earnest in March 2021 as the market started revealing some seasonal strength. After a long stretch of weaker prices, the fed market was finally better on a year-over-year basis (admittedly, against very weak Covid market comps).

Streak

Related: Record highs and strong demand fuel cattle market surge

Now turn your attention to the chart. Beginning in March 2021, there have only been four (out of 201) weeks in which the market was NOT better year-over-year (one week at the end of March 2021 and three weeks in September 2024).

During that time, the fed market has added on an average of $.40/cwt on a weekly basis – or the equivalent of ~$21/cwt every year. And it’s that trend that further reinforces better feeder prices; recency bias has cattle feeders betting on the come.

Demand Driven

Now the cynics would read all that and point to declining cow inventory as the primary driver of a stronger market. Perhaps that was true in ’14 and ’15 – but NOT this time. Despite declining cow numbers, fed beef production has remained surprisingly ample. 2022 established a new annual record at 22.98 B lb. Meanwhile, 2024’s final tally has yet to be made, but production will be bigger than last year and only about 2% behind 22’s record pace.

In other words, stronger prices are not supply-driven (like ’14 and ’15) but rather are largely demand-driven. Record consumer spending – and solid export activity - in ’24 has been the difference maker! (More on that in future columns.)

Consumers Are the Business

As noted above, there was lots of consternation in ’21 and ’22. “The market is broken” became a familiar theme

Related: Weather Update: January 7, 2025

among some groups in the industry – especially those who wanted to burden the industry with new government mandates. Even after a year of better prices, the “market-fixers” were critical of anyone who contended the market would find its way. It wasn’t really “broken” – but some groups never want to let a crisis go to waste. To that point, I’m reminded of Dr. Craig Pirrong’s great observation : “A market is broken when it sends the wrong price signals. It is not broken if it sends the right signals, even if you don’t like them.”

Based on an absence of emails of late, I’m assuming the market is no longer “broken”. Therefore, either 1) the market somehow inexplicably fixed itself (without anything changing), or 2) as alluded to above, it wasn’t broken to begin with.

That brings us back to beef demand; it always has been and continues to be the difference maker. Consumers ARE the business – they’re the market makers - not government mandates or programs.

.jpg?disable=upscale&width=1200&height=630&fit=crop)