What beef consumers want and what it means for producers

Posted on January 15, 2024 by Ted Schroeder

Source: Farm Progress. The original article is posted here.

Practically every new dollar that enters the U.S. beef industry originates from consumers who purchase beef products. When consumer beef demand is robust, beef industry participants flourish. But when demand is sluggish, industry participants are immensely challenged. Anything producers can do to positively influence consumer demand for beef will ultimately benefit them.

With funding assistance from the Kansas Beef Council, we are currently completing a study designed to rank factors affecting consumer beef purchase behavior. In the study we sought to rank factors affecting beef purchasing decisions by consumers. To accomplish this, we conducted a nationally representative survey of 3,001 U.S. consumers to identify and measure importance of factors influencing beef product purchasing decisions. Results reveal numerous things cattle producers can do to enhance beef demand.

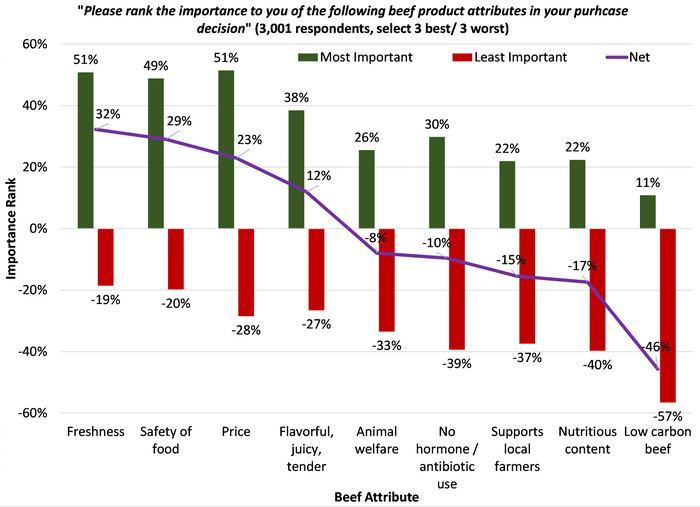

In the survey consumers completed a set of questions in which they ranked the importance of nine beef product attributes when making purchase decisions. Survey respondents indicated their 3 most and 3 least important among nine product attributes. Attribute rankings are summarized in the chart below. The chart reports percentages of respondents that rated each attribute as Most Important (positive green bars) , Least Important (negative red bars), and Net (purple line, Most Important plus Least Important ). More detailed results of study are available here and here .

Source: Kansas State University

Key findings:

Product freshness, safety, price and flavor were the top ranked attributes overall with the two most often ranked Most Important being product freshness and price. This is a common result found in several recent studies.

Next in line of importance overall included animal welfare, use of hormones, and antibiotics in producing beef, and supporting local farmers.

The lowest ranked attribute, by a sizeable margin, was low carbon beef, defined as beef produced with 10% lower greenhouse gas emissions.

Each of the nine attributes were identified as Most Important by at least some consumers. This indicates there are opportunities for niche markets for perhaps every attribute presented, even the least frequently identified as important attribute of low carbon beef – 11% of consumers indicated it was important.

What can producers do with this information (see our article for further details)?