Slaughter cattle and ground beef market soars

Posted on March 12, 2024 by Derrell Peel

Source: Farm Progress. The original article is posted here.

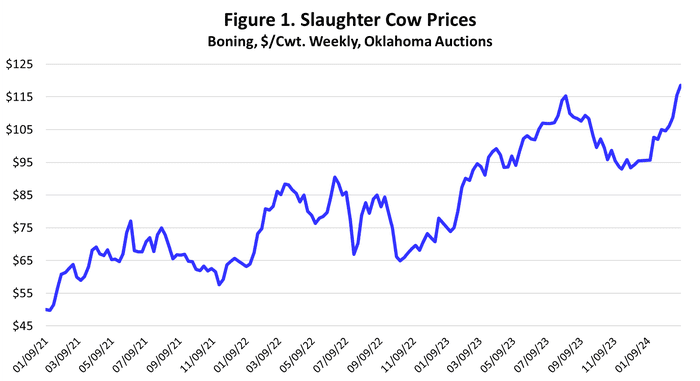

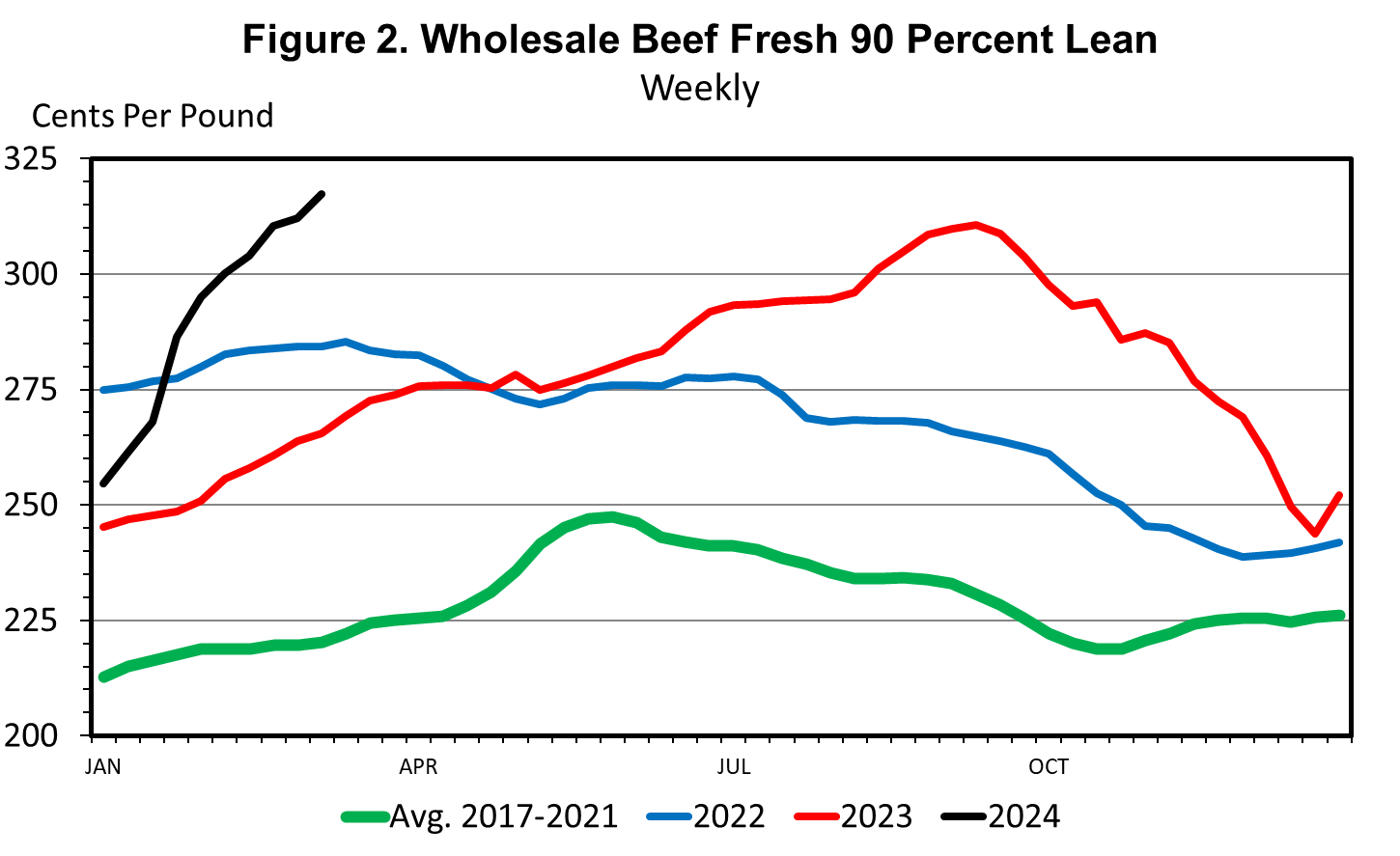

Slaughter cow prices are driven by the price of 90 percent lean beef trimmings (90s), which posted a price of $317.36/cwt. the first week of March. This is a record high price for 90s in data back to 1978 and undoubtedly an all-time record weekly price. The supply of non-fed beef (cow + bull) is down 12.7 percent year over year thus far in 2024, the result of a 13.1 percent year-to-date decrease in cow slaughter. Dairy cow slaughter is down 15.0 percent and beef cow slaughter is down 11.4 percent year over year, while bull slaughter so far in 2024 is down 9.4 percent from one year ago.

Lean beef trimmings are a key component of ground beef production. A wide variety of lean and fatty trim products are used to provide ground beef supplies for food service and retail grocery markets. A standard reference for ground beef values is the ratio of five pounds of 90s to one pounds of 50s (50 percent lean trimmings), which is equivalent to 83.3 percent lean ground beef. The increased price of 90s has pushed this reference price of wholesale ground beef to $281.28/cwt. in the first week of March. This reference price of ground beef was exceeded only one week during the pandemic disruptions in 2020 and is otherwise at an all-time high.

The major portion of U.S. beef imports is lean beef used for the ground beef market. As domestic lean beef supplies decrease and prices increase, markets respond with increased beef imports to moderate impacts domestically. Accordingly, beef imports in 2023 increased 9.9 percent year over year. In the latest data for January, beef imports were up 38.1 percent year over year. Beef imports are typically front-loaded in the new year as countries, especially Brazil, scramble to fill the unassigned “Other Country” import quota. Monthly imports will moderate later in the year and total imports for 2024 are projected to increase 12-13 percent year over year.

Slaughter cow and wholesale ground beef prices are expected to move higher in the coming months. Net cow culling (beef and dairy) decreased to 17.2 percent in 2023 from the cyclical peak of 17.8 percent in 2022. However, during the last herd expansion, net cow culling decreased to a low of 13.3 percent in 2015. Without herd rebuilding, cow slaughter will decrease in 2024 simply because cow inventories are smaller; if herd rebuilding begins in earnest in 2024, cow slaughter will decrease more sharply.

.jpg?disable=upscale&width=1200&height=630&fit=crop)