Mr. and Mrs. Smith

Posted on October 27, 2025 by Nevil Speer

Source: Farm Progress. The original article is posted here.

Cow numbers and production. Amidst all the public discourse about retail beef prices in recent weeks, many people increasingly attribute higher prices to lower cow numbers: “Prices are up because cow numbers are down.” That logic doesn’t work.

Sure, compared to 10 years ago, beef cow inventory is down 1.5 million head (approximately 5%). But this year’s domestic beef production will surpass 2015 by nearly 2.7 billion lb. (+11%). The industry’s productivity continues to advance – i.e., producing more beef with fewer cows. And when it comes to price, demand has been the real difference maker over time. (For more on beef demand, see column listing below).

Politics. But all this gets really wonky when the explanation gets leveraged as an excuse for protectionism. For instance, R-CALF USA provides this explanation on X :

“The U.S. beef cow herd is the smallest it’s been in 70 years. Imports now make up more than 20% of domestic consumption – double what they were 40 years ago. Imports aren’t ‘filling a gap.’ They’re replacing what American ranchers used to raise here at home. It’s time to protect the U.S. market, rebuild our herd, and restore truth in labeling.”

Before we dig into some data, it’s important to note that imports don’t really “fill the gap.” Rather, beef imports primarily consist of lean trimmings to complement domestic production. In turn, that boosts the value of 50/50 trim that would otherwise be essentially worthless. As such, trade enables U.S. producers to specialize and capitalize on what they do best – produce high-quality beef.

Related: Quality and consistency: Stay the course

Data. The Table categorizes the past 20 years relative to changes in beef cow inventory (up versus down). It further details those changes by the relative change in annual beef and live animal imports. Columns 4 and 5 represent the R-CALF narrative – more imports equal fewer cows (and vice versa). However, those columns account for only seven out of 20 years. In other words, nearly two-thirds of the time, the trend deviates from the import / cow talking point cited above.

And as it relates to the other talking point (labeling and cow numbers), here’s a quick factoid. During the past 20 years, average annual liquidation during country-of-origin (COOL) versus non-COOL years is essentially identical (233,000 vs. 245,000 head, respectively), not to mention that cow numbers declined five out of seven years of COOL. Again, the talking point doesn’t work. (For more on COOL, see my column listing below.)

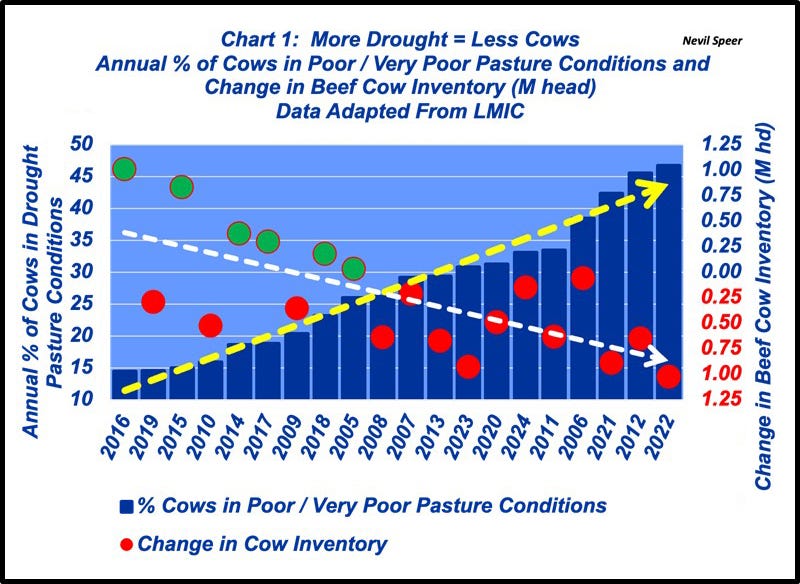

Weather. Chart 1 categorizes the past 20 years by the percentage of cows in poor/very poor pasture conditions (i.e., drought). It also includes the respective change in cow inventory. The trend couldn’t be clearer: More drought equals fewer cows (the correlation approaches 0.7).

Related: Cattle markets: Reflecting on the bigger picture

Now for some additional context. Turn your attention back to column 5 (R-CALF narrative) in the Table. It includes 2012, 2020 and 2023 – significant drought years. Moreover, it also includes 2019 – recognized as the year of the flash drought. That leaves ONLY 2009 as matching the narrative; as a reminder, that was also the closing year of the financial crisis.

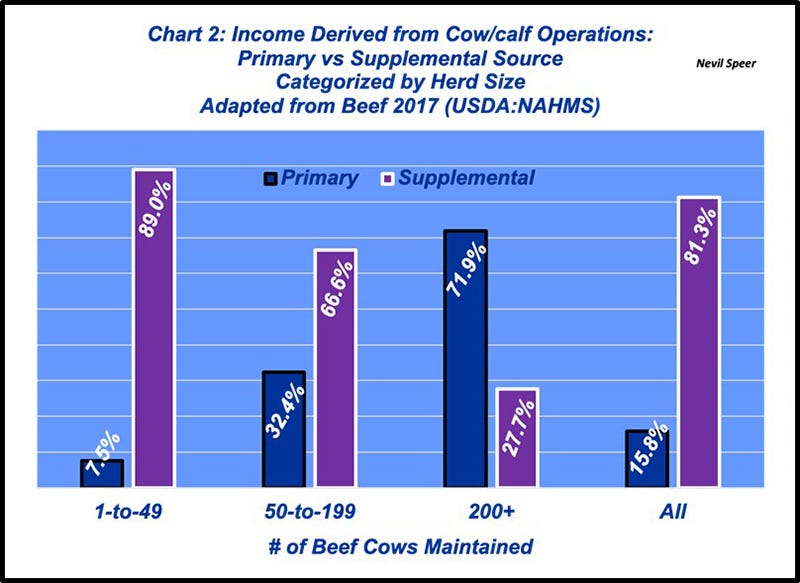

Mr. and Mrs. Smith. Why do producers ultimately sell their cows? That’s difficult to pinpoint, because for most producers (80+%), the cowherd is NOT the primary source of income (see Chart 2). Given that reality, now envision Mr. and Mrs. Smith at their kitchen table discussing whether they should sell their cows. Their attention, especially in drought years, is on the immediate concern – i.e., shortage of hay/pasture and/or stock water – not on imports.

But let’s not also overlook lots of other drivers explaining why they might sell their cows: death, divorce, no children interested in coming home, an unimaginable offer for their land, rising equipment costs, lack of credit access … and the list goes on. The point being, given all we know about the realities and complexities of the business, are imports really driving Mr. and Mrs. Smith to sell their cows? And will COOL really prevent them from doing so? Not so much.

Related: Cattle auction prices react to futures market volatility

For more on COOL, see: