Looking ahead to 2025’s starting inventory

Posted on December 26, 2024 by Nevil Speer

Source: Farm Progress. The original article is posted here.

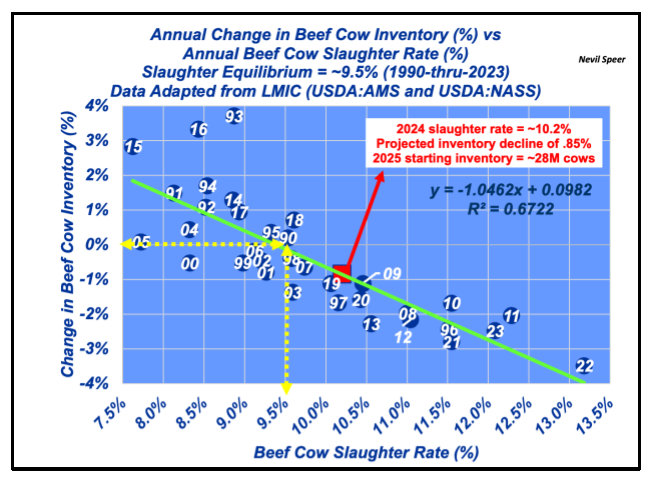

Number Six : The beef industry has witnessed five consecutive years (’19-thru-’23) of declining beef cow inventory. Sooner-or-later that trend has to reverse course – right? And during the past year, there’s been lots of discussion in the ag media about the overall decline in cow slaughter numbers. So, surely 2024 must have been the year for that to happen – also right? Not so fast; 2024 is shaping up to be year number six.

Slaughter Rate: While it’s true that cow slaughter sharply declined during the past year, the absolute number doesn’t really tell us much; it’s the relative number that matters. That is, the true indicator of producer intentions is the slaughter rate (total slaughter as proportion of beginning inventory). It’s not a perfect predictor (more on that below), but it’s a fairly reliable indicator of which direction the cowherd is headed.

The chart below highlights annual slaughter rate versus the next year’s starting inventory. Through November, beef producers have marketed 9.35% of 2024’s starting inventory. And if we assume another .85% through December (we’ll know the final numbers in mid-January from USDA), that’ll bring the slaughter rate to 10.2% for the year. Based on the data, beef cow inventory will likely have declined another .85% during the year. Net-net: the U.S. beef cow inventory will likely start 2025 with fewer cows (~28M) versus last year’s mark (28.2M head).

Related: Need to reduce 2024 income? Here are some ideas

That directional trend is further reinforced by the quarterly heifer feedlot inventory. Heifers have comprised roughly 39.5% of total feedyard population during the past several years (the most recent reading occurring in October). No matter how you slice it, producers aren’t signaling any meaningful intention to start rebuilding the nation’s cowherd.

Survey: As noted above, none of that is a perfect marker. Don’t go betting the 28M number; there’s lots of room for some over-or-under. Primarily, it’s contingent on last year’s starting number. And depending on how the cattle inventory survey shapes up, the 2024 benchmark is subject to revision (which some years can be sizeable).

Surveys are an imperfect tool (albeit far better than nothing) and there always exists possibility of corrections. Therein lies the next important part of all of this – response rate. It’s key to ensuring the estimates are as accurate as possible.

Of course, that has broader implications for the entire industry. USDA explains the survey, "helps packers and government leaders evaluate expected slaughter volume for future months and determine potential supplies for export, as well as aid in determining program and resource needs in times of emergencies. Obtaining the current count of cattle will serve as an important decision making tool for the entire agricultural industry.”

Related: Farm Progress America, Dec. 26, 2024

There is no such thing as a perfect count. However, active producer participation in the survey helps ensure that “close” really is just that. Ultimately, better response rate leads to more precision, and that benefits all stakeholders.

Big Picture: Whatever the number turns out to be, cow/calf producers still have not turned their attention to rebuilding. The question that immediately follows is something like, “What will it take to make that happen?” There’s no perfect answer because every operation is different, but it includes regulatory certainty, interest rate stability, slowing equipment cost inflation, and long-run confidence that drought will quit rearing its ugly head.

Then, question number two goes something like, how will we know when the trend changes course? My response is typically something like, “We’ll know it when we see it.”

But in the meantime, I don’t hear too many producers complaining. In the big picture, continued tight numbers (along with stellar consumer demand) means cow/calf producers are in the driver’s seat for the foreseeable future.

Related: Cornbelt Cow-Calf Conference 2025 focuses on marketing, management

.jpg?disable=upscale&width=1200&height=630&fit=crop)