Impact of beef-on-dairy on beef production small despite growing trend

Posted on September 4, 2024

Source: Farm Progress. The original article is posted here.

By James Mitchell, University of Arkansas; Kenny Burdine, University of Kentucky; Livestock Marketing Information Center

Growth in beef-on-dairy has raised several questions, including the impacts of the system on U.S. beef production. Recent estimates picked up by the farm press suggest that beef-on-dairy represented 7% of 2022 cattle slaughter, or 2.6 million head. The same source predicts that beef-on-dairy could account for 15% of cattle slaughter by 2026. There is nothing wrong with these numbers, but some context should be added regarding how this would impact U.S. beef production levels.

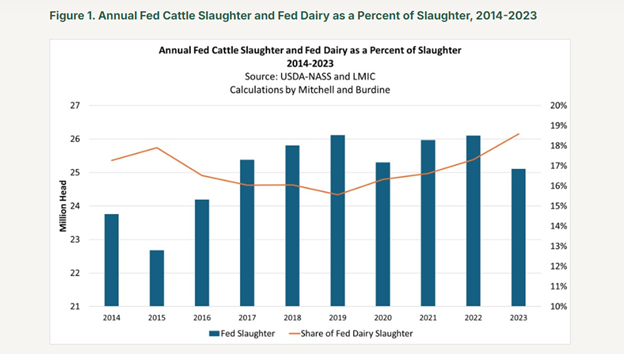

It is important to recognize that beef-on-dairy does not immediately change the number of calves born to dairy cows annually. Therefore, it does not necessarily mean more cattle entering the beef production system. The first figure in this article shows annual fed cattle slaughter. The figure also shows that fed dairy as a percent of total fed cattle slaughter has remained relatively constant from 2014 to 2023, ranging from 16% to 19%. In 2023, fed dairy cattle slaughter was estimated at 4.67 million head, or 19% of total fed cattle slaughter. The increase in fed dairy relative to total fed slaughter from 2019 to 2023 is a function of the cyclical decline in cattle inventories – beef cattle numbers decreased while dairy cattle numbers increased. As growth in beef-on-dairy continues, we will observe a decrease in traditional fed dairy cattle slaughter and an increase in beef-on-dairy cattle slaughter. The key point being that this is a tradeoff, not a net gain in dairy slaughter.

How widely adopted is beef-on-dairy and how much growth do we expect going forward? Extrapolating data from Lauber et al. (2023) implies that beef-on-dairy grew from 18%, or 738,000 head, in 2019 to 26%, or 1.12 million head, in 2021. More recently, the National Association of Animal Breeders reported sales of beef semen to the dairy industry totaling 7.9 million or 31% of total semen sales to dairy, including sexed, conventional, and beef semen sales (NAAB, 2023). Since there is likely no significant cost difference from using beef semen in the dairy herd, it is not unrealistic to expect that beef-on-dairy will become widely adopted in the dairy industry over the next few years.

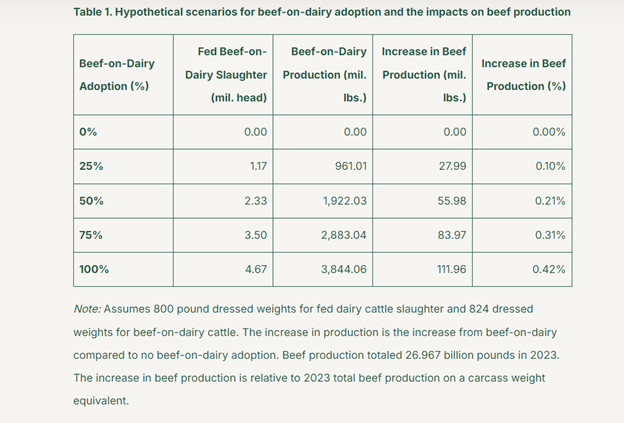

The table in this article shows a range of beef-on-dairy adoption rates (0% to 100%) and the hypothetical impacts on 2023 beef production. In these scenarios, beef-on-dairy adoption refers to the share of non-replacement-intended fed dairy cattle slaughter that is from beef-on-dairy crosses. As beef-on-dairy transitions from 0% to 100% adoption, a larger share of fed dairy slaughter will come from the latter. If the adoption rate were 100%, this would equate to an estimated 4.67 million head of non-replacement dairy calves being beef-on-dairy cattle, or about 19% of 2023 fed cattle slaughter. But the supply of fed dairy cattle does necessarily increase; beef-on-dairy just represents an increasing proportion of that supply.

While the total number of cattle fed annually may not change, increasing adoption of beef-on-dairy has the potential to impact the type and quality on a portion of those cattle. In order to specifically estimate the impact on beef production, assumptions must be made about potential changes in dressed weights when a share of traditional fed dairy cattle are replaced with beef-on-dairy fed cattle. The analysis begins with the assumption that traditional fed dairy cattle averages 800-pound dressed weights (1,400 pounds live weight) with a dressing percentage of 57%. Using that as a starting point, and assuming zero beef-on-dairy adoption, beef production from fed dairy cattle would have totaled around 3.73 billion pounds in 2023 (800 pounds times 4.67 million head). This would have represented 13.8% of total 2023 beef production on a carcass weight equivalent.

It would seem reasonable to assume that use of beef semen on dairy would potentially bring live weights down and pull dressing percentages upward. If the increase in dressing percentage offset the decrease in liveweights such that carcass weights increased by 3%, this would be roughly a 24-pound increase for beef-on-dairy fed cattle. Using this 24-pound increase, had beef-on-dairy adoption had been 100% in 2023, production from beef-on-dairy would have totaled around 3.84 billion pounds (14.3% of total U.S. beef production on a carcass weight equivalent). That additional 112 million pounds would represent an increase in annual beef production of 0.42%. Put simply, moving the assumption from 0% to 100% adoption would have increased 2023 beef production by less than half a percent. Importantly, recognize that some of the impact on beef production has already been internalized because beef-on-dairy adoption has already reached 30-50%.

There are some additional points that should be made about the estimates discussed above and shown in the table. The first involves the percent of beef-on-dairy semen that is potentially sexed. Anecdotally, we got mixed answers, with some people telling us 5% and others telling us nearly 100% of beef-on-dairy semen sales are sexed. If a larger share of beef-on-dairy calves are steers, the impact on beef production would be larger as steers will have higher dressed weights. But even if we double the impact on carcass weights to 50 pounds, the change in total beef production is still less than 1%.

Another question involves how beef-on-dairy potentially changes the relative value of a dairy heifer. Are there situations where a dairy heifer is worth more as a beef animal than a dairy replacement? If so, that could increase the total number of beef-on-dairy cattle. That also raises questions about second-order effects. Does the profitability of beef-on-dairy mean more dairies? Milk production will remain the focus of dairy operations, but increased calf values have the potential to impact profitability. If this encourages some expansion of the dairy herd, that would further impact beef production levels.

Finally, beef-on-dairy will impact beef quality grades and change the volume of eligible products for branded beef programs. It will change how we market approximately 15% of U.S. beef production. That's an important consideration, but we do not think it will erode beef quality premiums. Other considerations include the downward trend in veal slaughter which coincides with the increase in beef-on-dairy.

Beef-on-dairy is an important change for both the beef and dairy industries. During the liquidation phase of the cattle cycle, beef-on-dairy will reflect a larger share of total fed cattle slaughter. This is especially true as more dairies adopt beef-on-dairy crosses to improve the value of their calves. Still, the impact on total beef production is likely to be relatively small and will depend on how beef-on-dairy changes the structure of the dairy industry. It is an important development that we should continue to monitor.

.jpg?disable=upscale&width=1200&height=630&fit=crop)