How to win in the beef margin game

Posted on December 27, 2023 by Lee Schulz

Source: Farm Progress. The original article is posted here.

Cattle feeding and beef packing are both margin businesses.

In cattle feeding, the margin is the value the feedlot gets for the fed steer or heifer, less the feeder purchase cost and costs to feed the animal. In beef packing, the margin is the value of the beef cuts plus byproducts, less the cost of the fed animal and costs to slaughter and process it.

Price discovery for fed cattle begins with the market average price level. Beef packers buy fed cattle over a range of prices around the market average price. Packers do not determine the market average price because they don’t control supply or demand. But packers can influence prices paid around the market average price level as they arrive at a transaction price for a given quantity and quality of cattle at a given time and place.

Similarly, beef packers sell beef cuts and byproducts over a range of prices around the market average wholesale price. They do not determine the market average wholesale price. But they can influence prices received around the average price level through price discovery.

Cost control is crucial

Suppose all packers generally receive the market average wholesale price for beef cuts and byproducts. Further suppose all packers pay the market average price for fed cattle. If so, then packers have about the same gross margin. Then the packer with the lowest costs will capture the largest net margin or profit. Therefore, packers seek ways to control costs per head slaughtered as an attempt to improve net margins.

Packing plants have fixed costs and variable costs. Some fixed costs are depreciation of the plant and equipment, interest, insurance, and property taxes. Some variable costs are labor, utilities and shipping.

Bigger plants may have lower fixed costs per head of total capacity. Bigger plants have potential to spread their fixed costs over more head of cattle actually slaughtered, which can lower total cost per head.

However, to realize their potential advantage over smaller plants, larger plants must operate at near capacity all the time. A larger plant operating at a lower level of plant utilization may have higher costs per head slaughtered than a smaller plant operating at near capacity.

Published data on costs limited

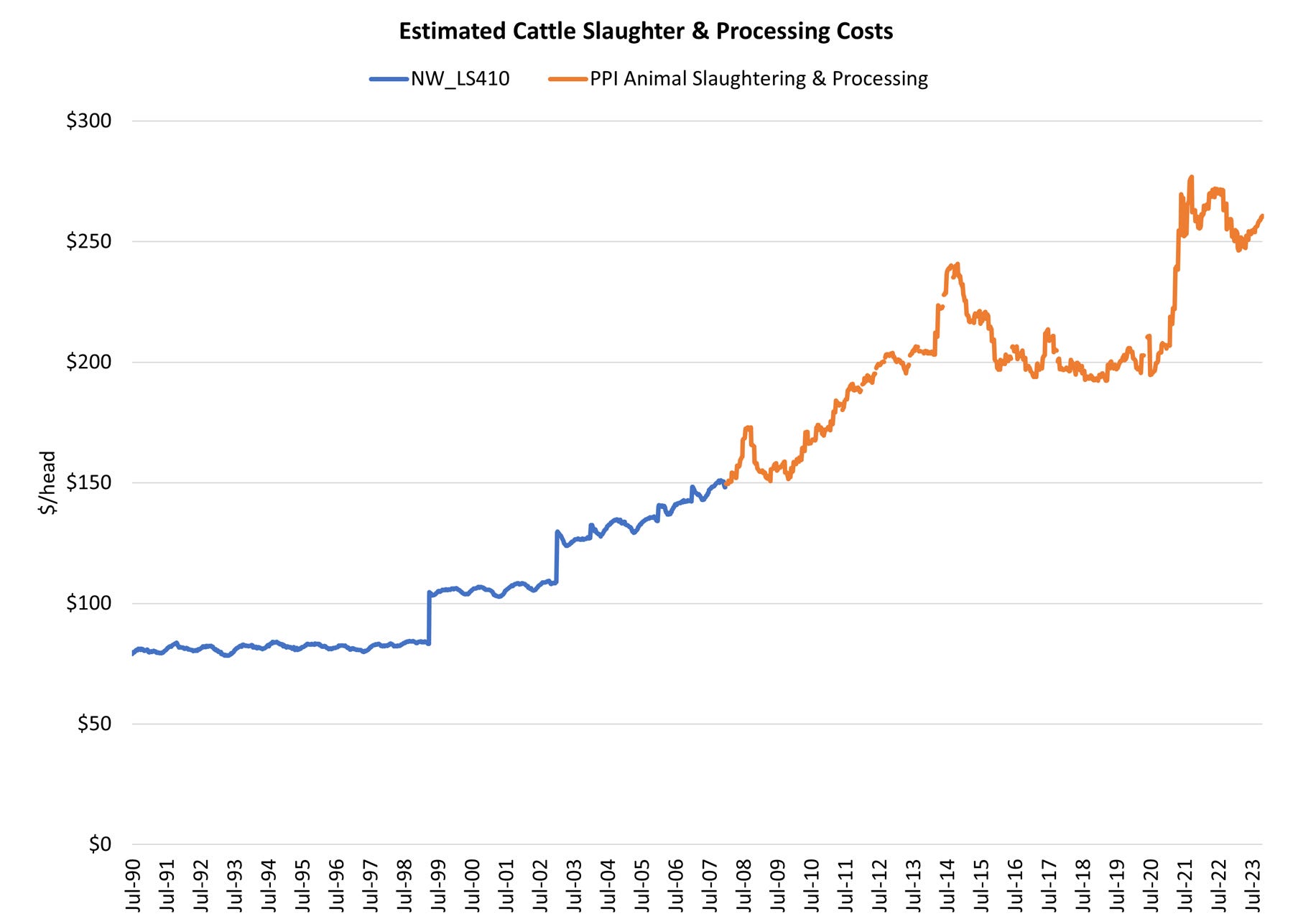

The weekly USDA Beef Carcass Price Equivalent Index Value report is an antiquated report that provides, among other things, information on slaughter and processing costs. Packers voluntarily provided the cost information. When it was last updated in 2007, the processing cost was $12 per cwt and the slaughter cost was $50.50 per head. Multiplying the per-hundredweight processing cost by a dressed hundredweight gives a per-head processing cost.

USDA has received good participation from packers in supplying yield information to calculate beef carcass cutout and primal values. That same level of participation has not occurred for sharing of cost information. This is a business decision. Revealing costs can give an edge to competitors. Low participation results in insufficient data to determine an industry average slaughter and processing cost.

Even if cost data were readily available, costs most certainly vary dramatically across plants, so any one average number wouldn’t represent costs very well. Furthermore, information is not available on the proportion of costs that are fixed vs. variable.

Nonetheless, knowing packer costs is important. For a margin business, over time (not necessarily for a day, a week, a month or even a year) the market will pay, on average, the fair cost of production ― no more and no less. This includes a fair return to the resources used and the risk of employing them to produce.

Indexed series provides approximation

The U.S. Bureau of Labor Statistics builds a producer price index for animal slaughtering and processing (NAICS Code 31161). This index can be used to continue the NW_LS410 report series by setting December 2007 as the base date. Doing so provides an up-to-date time series of beef packer costs that are in line with industry estimates. Beef packing costs averaged $200 per head from 2016 through 2020, according to the indexed series. Costs surged in 2021 and 2022 amid inflationary pressures. Recently, costs have been above $250 per head.

However, any reports on packer costs are coarse. The main conclusion that can be drawn from them is that the long-term trend in costs is up.

Data source: USDA Market News Service and U.S. Bureau of Labor Statistics. Calculations by Lee Schulz. May 2020 data omitted due to COVID-19 disruptions.

Good margins occur at wrong time

Packers can manage through tighter margins when slaughter levels are big. Wider margins are needed when numbers are small. To the contrary, the supply situation propels margins in the opposite direction — that is, tighter margins when cattle numbers are low and wider margins when numbers are high.

The clearest indicator of which beef packers have the highest costs, and tightest margins, is who idles capacity when fed cattle supplies are small.