Cash cattle prices ease as futures rebound

Posted on September 26, 2025 by Trey Freeman

Source: Farm Progress. The original article is posted here.

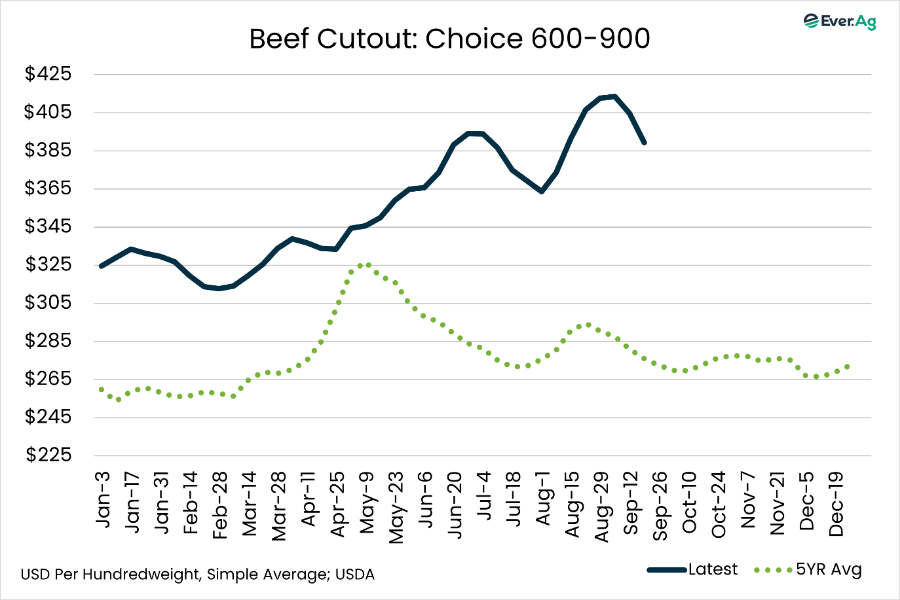

Boxed beef cutout values were lower for the second consecutive week, a common theme in September. The weekly average choice price was $15.33 per hundredweight, lower at $389.44. Select was $14.96 per hundredweight, lower at $367.91. Seasonal price action suggests another two weeks of weakness before finding traction in early October on account of the upcoming holidays.

Last week’s slaughter estimate came in at 552,000 head, 13,000 less than the week prior and 62,000 less than a year ago.

Official slaughter data for the week ending September 6 showed dressed steer weights climbed to 958 pounds, 5 heavier than the week prior and 17 heavier than a year ago. Dressed heifer weights were 866 pounds, 1 heavier than the week prior and 20 heavier than a year ago.

Front-month October live cattle futures settled at $233.575 per hundredweight on Friday, up $3.60 on the week, while the December through April contracts were up $3.80 to $4.525 on the week. Feeder cattle futures were higher on the week as well, with front-month September finishing at $359.15 per hundredweight on Friday, up $8.75 on the week, while the deferred 2025 contracts were up $7.675 to $8.30 on the week.

Related: Better beef for your budget

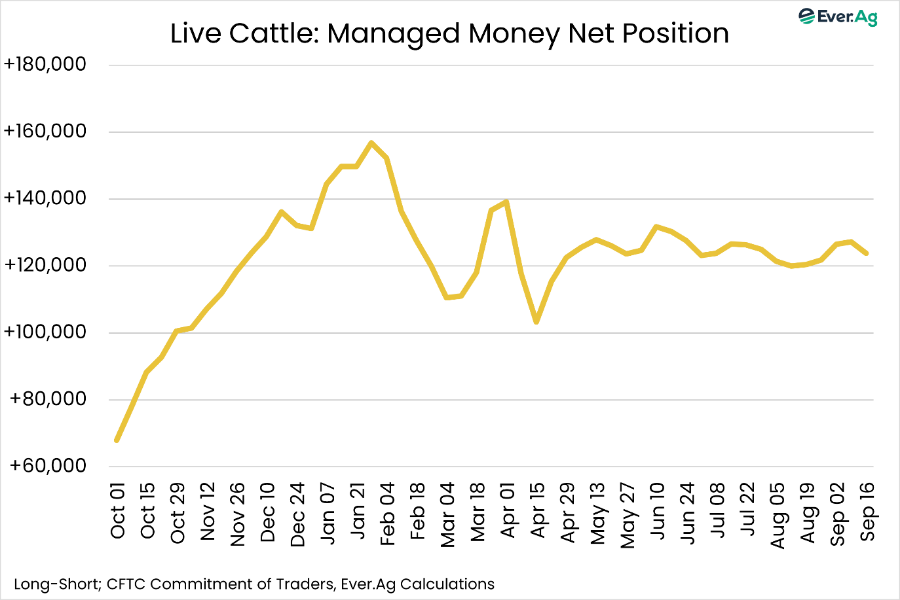

The CFTC Commitment of Traders report released Friday, reflecting positions as of Tuesday, September 16, showed managed money decreasing their net long position in live cattle by 3,522 contracts, now holding long 123,750 contracts. In feeder cattle, managed money added 102 contracts to their net long position, now net long 25,412 contracts.

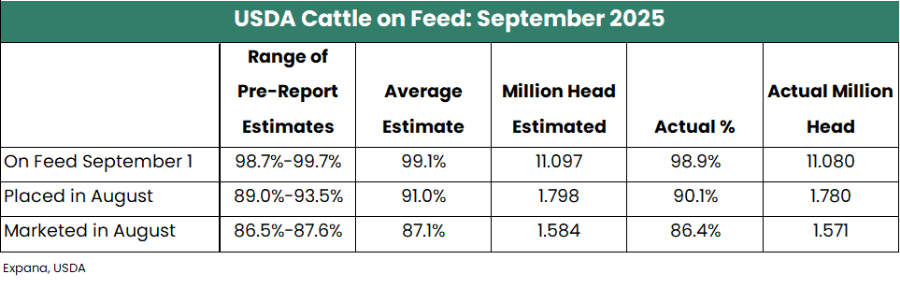

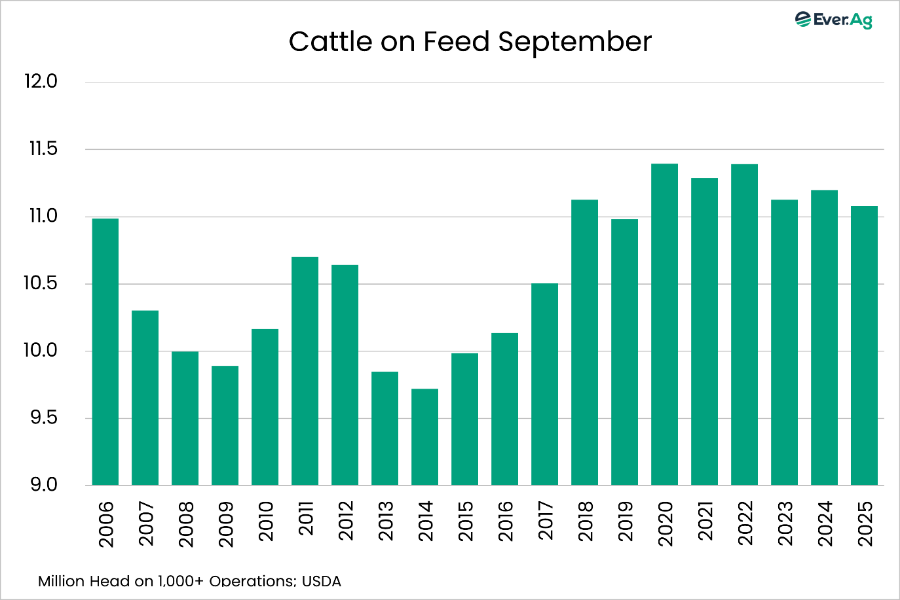

The September Cattle on Feed report was neutral overall, with all three numbers near the pre-report estimates.

The on-feed number for Texas came in at 91% of last year, down 250,000 head. Colorado was 92% of last year, down 80,000. Oklahoma came in at 95%, down 15,000. Increases in on-feed numbers were reported in Nebraska, Kansas, and Iowa. Nebraska at 105% of last year, up 110,000. Kansas at 103%, up 70,000. Iowa at 105%, up 30,000.

Overall, the state-by-state on-feed numbers for September 1 align with the shift in price relationship between the southern and northern plains states. Historically, the price spread between Nebraska and Texas has narrowed dramatically from its mid-summer high. By early September, the spread tends to level off with Nebraska maintaining a small premium to Texas of around $1 to $2 per hundredweight. This usually lasts until December. However, after last week, Texas is carrying a premium to Nebraska of about $3 per hundredweight. Ultimately, this reflects the severity of how tight feeder supplies have become in Texas due to the Mexican border closure to feeder cattle. Moving forward into the last quarter of this year, it appears there is a decent chance that this atypical price relationship remains.

Related: Oh my gosh, it was so good!

Placements were lower across most states from year ago levels. In Texas, placements for the month of August were 82% of last year, down 75,000 head. Kansas at 89%, down 60,000. Colorado at 90%, down 15,000. Further north, placements in Nebraska were reported at 96% of a year ago, down 20,000, and Iowa at 87%, down 10,000.

Historically small showlists combined with one less business day in August lead to the sharply lower marketings number.

The risk of loss trading commodity futures and options can be substantial. Investors should carefully consider the inherent risks in light of their financial condition. The information contained herein has been obtained from sources deemed to be reliable; however, no independent verification has been made. The information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended to be a solicitation. Past performance is not indicative of future results.

Related: International market access developments for U.S. beef

This week, cash markets for fed cattle will likely remain under pressure as boxed beef prices continue to slide. Beef demand does not tend to pick up for a couple more weeks, so cash will likely be on the defensive until then. The reprieve in live and feeder cattle futures this week, following two consecutive weeks of losses, was a breath of fresh air. Futures remain shaky, however. Cash markets need to show some durability this week. Although futures finished strong, it was still an inside week on the charts for live cattle, suggesting they aren’t out of the woods yet.