Beef exports bring $721 million to Iowa

Posted on November 20, 2023 by Lee Schulz

Source: Farm Progress. The original article is posted here.

Political climate, currency exchange rates and general macroeconomic conditions influence beef trade. Differences in resource bases among countries, preferences for different cuts of beef, barriers to trade and industry structure are even bigger factors, especially in the long term.

The parts of the world with low-priced inputs including feed, labor and capital have competitive advantages in beef production. Land for forage and grain production is critical for cattle operations. It is possible to ship hay to cattle on farms around the world. But grazing cattle on pastures or harvesting forages near where cattle are being raised are both more cost-effective. Cattle feeders add value to crops by converting feedstuffs to beef. Competitiveness in beef processing comes from large and reliable supplies of cattle, lower operating costs through economies of scale, and a profitable marketplace for a full range of beef cuts and byproducts.

The quarterly Livestock and Poultry: World Markets and Trade report, published by USDA's Foreign Agricultural Service, provides data on U.S. and global trade, production, consumption and stocks, as well as analysis of developments affecting world trade in beef and veal, cattle, swine, chicken meat and turkey meat.

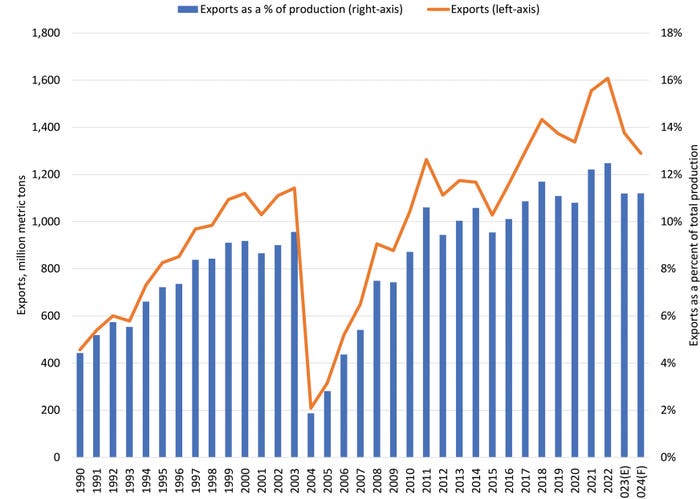

EXPORTS: Both U.S. beef exports and exports as a percent of total production retreat from 2022’s record highs. (Courtesy of USDA Foreign Agricultural Service)

In 2022, the United States ranked first internationally in beef and veal production with 12.890 million metric tons (MMT, carcass weight equivalent).

The United States ranked second in beef and veal export volumes in 2022, with 1.608 MMT. Brazil ranked first with 2.898 MMT. In 2023, the United States is expected to dip to fourth in export volume at 1.376 MMT behind Brazil (2.750 million), Australia (1.530 million) and India (1.420 million) where Indian exports are carabeef (water buffalo). That ranking is forecast to hold in 2024.

U.S. beef exports lower but still robust

With higher U.S. beef production for much of 2022, strong global beef demand and limited exportable supplies from Australia, U.S. beef exports surged. Those factors have changed. As a result, U.S. beef export volumes are smaller than 2022’s record. However, 2023 U.S. beef exports are only expected to be slightly below the 2017-2021 average.

U.S. beef exports accounted for 10.9% of total U.S. beef production in 2017, 11.7% in 2018, 11.1% in 2019, 10.8% in 2020 and 12.2% in 2021. In 2022, this ratio was 12.5%. While beef exports have dipped in 2023 and are forecast to further dip in 2024, exports as a percent of total production are expected to be at 11.2%.

International agricultural trade matters to Iowa

Data necessary to directly track agricultural exports back to their original source of production are scarce. USDA’s Economic Research Service estimates a state’s export value for a commodity by multiplying each state’s share of total U.S. farm receipts for a commodity by the U.S. export dollar value corresponding to that same commodity. For example, multiplying Iowa’s 17.8% share of U.S. farm receipts for corn in 2022 by the total value of U.S. corn exports of $18.571 million for the same year, equates to $3.303 million of corn exports from Iowa in 2022. Iowa is the No. 1 state for corn, pork and hide exports and No. 2 for soybean, soybean meal, vegetable oil and poultry other than broilers, i.e., eggs and turkey, exports.

Iowa is the fourth-largest beef exporting state at $721.1 million and 6.1% of total U.S. beef exports. Iowa is second to only California in total agricultural exports at $16.515 million and 8.7% of all U.S. agricultural exports.

The primary limitation of the allocating cash receipts approach is the assumption that all states export the same share of production. For example, California and Washington are assumed to export the same percent of their beef production as Iowa, despite these states’ comparative ease of accessing export markets via West Coast ports. Oakland is a principal U.S. gateway for beef exports to Asia. On one hand, this could result in underestimation of the West Coast states’ beef exports and an overestimation of Iowa’s beef exports.

Here is where Iowa has an edge

On the other hand, Iowa has a reputation for producing high-quality cattle due to its proximity to an abundant supply of corn and corn co-products, quality genetics and excellent stockmanship, which all help access key international beef markets. Beef quality is generally seen as the percentage of Choice and Prime — and in that regard, Iowa is a leader.

Another limitation of using farm cash receipts to compute state export shares is the difficulty in accounting for states’ roles in processing and adding value between farm and export locations. Most Iowa fed cattle are harvested outside the state. The export value of agricultural products is apportioned to states based on where the raw commodity was produced, not where the product was processed. A lack of slaughter and processing facilities for fed cattle represents a missed opportunity in Iowa’s economy.

Schulz is an Extension ag economist with Iowa State University.