Beef Checkoff cornerstone of success – “Then” to “now”

Posted on April 1, 2025 by Nevil Speer

Source: Farm Progress. The original article is posted here.

“Now” vs “Then”

My previous column about the Beef Checkoff provided some context around a recent post on X critical of the program . The post claimed, among other things, that producers’ share has declined since the passage of the Checkoff (1985). The column addressed that claim on two fronts:

The data presented on X wasn’t accurate.

The measure itself isn’t meaningful.

Consumption

Let’s turn to another measure that is often misused and misrepresented by Checkoff critics: beef “consumption.” The same post on X compares consumption “then” (1985) at 80 lb to “today” at 57 lb. The inference is that the Checkoff isn’t working because “consumption” has declined over time.

Let’s address this using the same approach as the previous column—but this time in the opposite order: first, the measure itself, and then second, the data.

Disappearance

There is no true measure of “consumption.” The appropriate term is “disappearance,” which is a derived metric calculated through several steps:

Supply = Total Production + Beginning Stocks + Imports

Disappearance = Supply – Exports - Ending Stocks

Per Capita Carcass Consumption = Disappearance / Domestic Population

Per Capita Retail Consumption = Carcass Consumption * Conversion Yield

Data

Now, let’s turn our attention to the data.

Related: Variety meat exports provide value to the U.S. beef industry

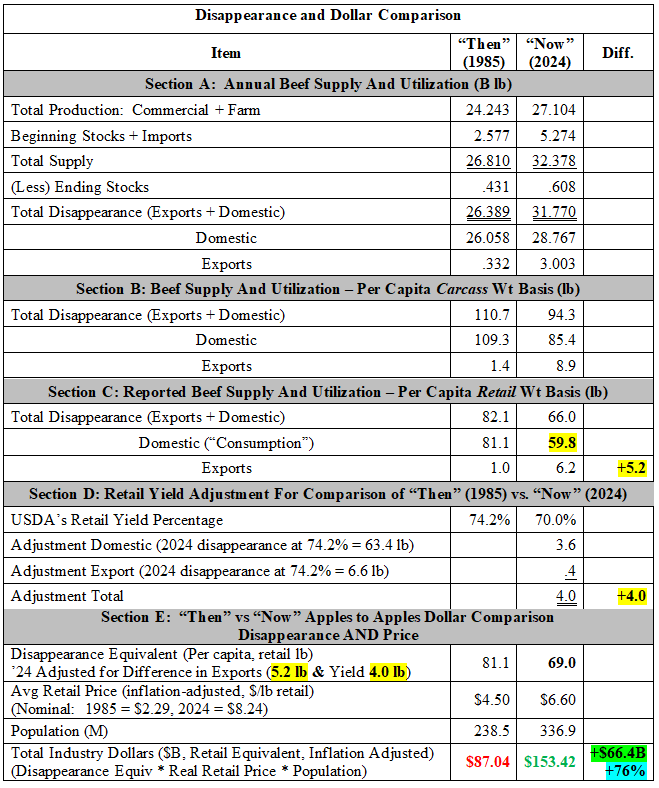

“Then” (1985) Vs. “Now” (2024) Disappearance and Dollar Comparison

“Then” (1985) Vs. “Now” (2024) Disappearance and Dollar Comparison

The table above outlines the actual data of “then” versus “now.” Several items are important to note:

Section A details total disappearance on a tonnage basis – both domestically and internationally.

Section B represents the data on a per capita carcass weight basis.

Section C represents the data on a retail weight basis (i.e., “consumption). Note the difference of the export equivalent over time ( 5.2 lb ). That is, part of the decline in domestic “consumption” can be attributed to bigger export volume.

Section D is especially important. That’s because the USDA changed their carcass-to-retail yield beginning in 1986 to account for the growing prevalence of closely trimmed retail cuts. In other words, any retail comparison following 1985 is inherently biased downwards because cutting yield has been adjusted. Therefore, the current data is adjusted accordingly –a difference of 4.0 lb .

Section E summarizes the previous four sections and provides an apples-to-apples comparison. Note that IF “consumption” includes accounting for both growing exports and yield change, the decline (12 lb) is only about half the difference reported on X (23 lb) . That’s a huge difference!

Related: CMC bringing Protein PACT to Canada

Dollars

This brings us to the measure itself. Without considering price, “consumption” doesn’t tell us anything about the viability of the business.

Dr. Wayne Purcell explained it many years ago this way : “…per-capita consumption is seen as synonymous with demand. Nothing could be further from the truth.” He further reminds us, “You can sell a quantity of anything at some price. In the case of beef, a perishable product, we consume essentially all we have. It is price that does the adjusting .”

With that, let’s return to Section E in the table. It includes inflation-adjusted retail prices and reflects population growth (a factor that Checkoff critics conveniently overlook, as the U.S. population has increased by 100 million people over the past 40 years). When all of that is considered, total dollars (inflation-adjusted) “today” exceed those of “then” by $66.4 billion (+76%)! Producer investment in research and promotion is doing exactly what it was intended to do—growing beef demand (both price AND volume).

Cornerstone

To revisit the key point: consumption is not a meaningful measure. The only thing that matters is dollars. Despite being a mature industry (i.e., no innovation leaps like the iPhone or updated pickup truck models with better engines), the beef business has managed to outgrow its competitors and outpace inflation. The Beef Checkoff is the cornerstone of that success from “then” to “now.”

.jpg?disable=upscale&width=1200&height=630&fit=crop)