Futures firm, cash prices higher as USDA reports offer no fireworks

Posted on October 28, 2024 by Trey Freeman

Source: Farm Progress. The original article is posted here.

Cattle markets ended the week with an influx of new USDA data.

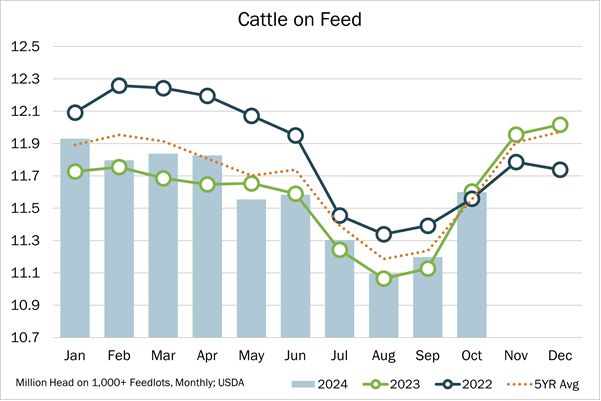

The latest “Cattle on Feed” report showed October 1 inventory at 11.55 million head, unchanged from last year's total. Analysts expected to see 99.7%. Placements came in at 98.2% of year-prior levels (versus expectations for 96.0%), and marketing landed at 102.0% (in line with expectations).

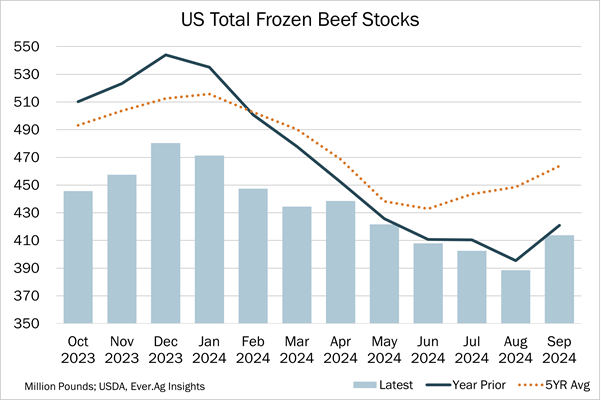

Meanwhile, frozen beef inventories totaled 463 million pounds on September 30, according to USDA's “Cold Storage” report. That was up 25 million pounds versus August (above the five-year average of +15 million), but down 2% year-over-year.

Other notable data for the week: slaughter was estimated to be 623,000 head, 15,000 more than the previous week, and 12,000 below the same week last year.

Looking at market activity, December live cattle futures closed at $189.15/cwt., up $1.825/cwt. while feeders finished at $248.575/cwt., up 97.5 cents/cwt.

The choice cutout for the week jumped to $322.33/cwt., up $1.59/cwt.

Cash markets for fed cattle traded at $190.00 to $191.00/cwt. in the South, $2.00 to $4.00/cwt higher on the week. In the North, fed cattle traded at $190.00 to $192.00/cwt, $2.00 to $4.00/cwt. higher.

The rally in Choice boxed beef prices stalled. Choice had experienced an approximately $25.00/cwt. rally over the last few weeks, helping packer margins to move into the black. With higher cutout values, packers have been more willing to pay more for fed cattle.

Dressed weights on steers came in unchanged on the week at 950 pounds. Reports said heifer weights were up six pounds at 863, a new record high.

December live cattle futures finished the week at $1.825/cwt. higher at $189.15/cwt. after making a new high for the move and getting to a place not seen since the first Friday of July. December closed above major trendline resistance on the weekly chart, something it failed to accomplish on two prior attempts. Live cattle charts continue to look friendly. A close above $190.00/cwt in December opens the door to the 2024 high in March of $191.60/cwt.

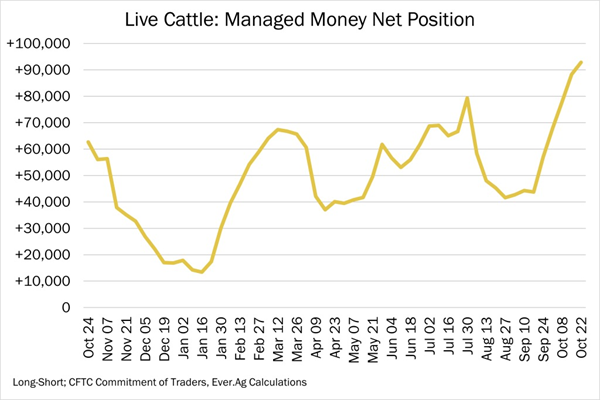

As of October 22, CFTC data showed managed money net long 92,825 contracts in the live cattle futures market. That's the biggest net long for managed money since October of last year. Managed money has now increased their net long position by nearly 50,000 contracts over the last five weeks. Seasonally, managed money tends to have little change in their net long position into end of year, however, last year they decreased their net long position by over 66,000 contracts from the same week into year-end, so keep an eye on potential downside if they start to unwind.

November feeder cattle futures finished the week 97.5 cents/cwt. higher at $248.575/cwt. Feeder cattle futures have traded mostly sideways for the last three weeks, posting an “inside” week on the charts for two consecutive weeks now, suggesting contracting volatility and a breakout to either side soon to come.

The risk of loss trading commodity futures and options can be substantial. Investors should carefully consider the inherent risks in light of their financial condition. The information contained herein has been obtained from sources to be reliable, however, no independent verification has been made. The information contained herein is strictly the opinion of its author and not necessarily of Ever.Ag and is intended to be a solicitation. Past performance is not indicative of future results.

.jpg?disable=upscale&width=1200&height=630&fit=crop)