Seasonality in feeder cattle prices

Posted on October 1, 2024

Source: Farm Progress. The original article is posted here.

By Hannah Baker, University of Florida / IFAS Extension

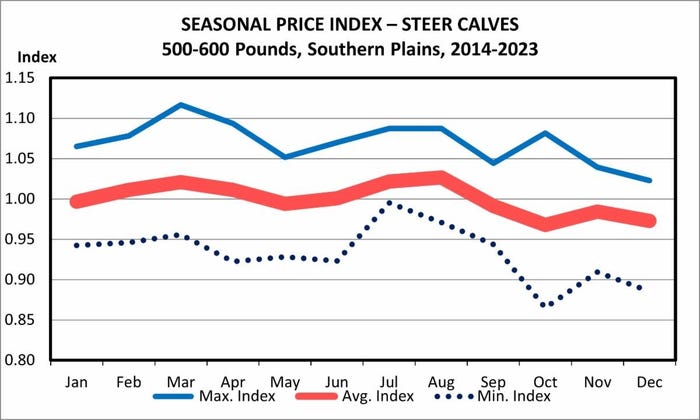

The fall months are when a majority of producers across the country are selling spring-born calves or yearlings from last fall. Due to the increase in supply of calves, prices typically decline during these months. A way to show this seasonality trend is to look at the seasonal price index. The average annual price index shows the relationship between each month’s average price and the annual average price. When the price index is above 100%, that means prices in that month, on average, are higher than the annual average, (spring). When the price index is below 100%, that means average prices in that month are lower than the annual average, (fall).

The maximum and minimum indices are used to show the approximate range of prices during that month. For example, during 2014-2023, average October prices in the Southern Plains were 96% of the annual average, but there was variability where prices ranged between 86% and 108% of the annual average for October.

The graph below includes 2023 when prices did not follow the seasonality trend of declining in the fall, but rather increased. For instance, average prices for 500-550-pound feeder cattle in Florida increased by 18% from March to October. On average from 2018-2022, prices during this same period declined by about 9%. Prices continued rising into 2024, but then began falling as we approached the summer and fall months, following the typical seasonality trend.

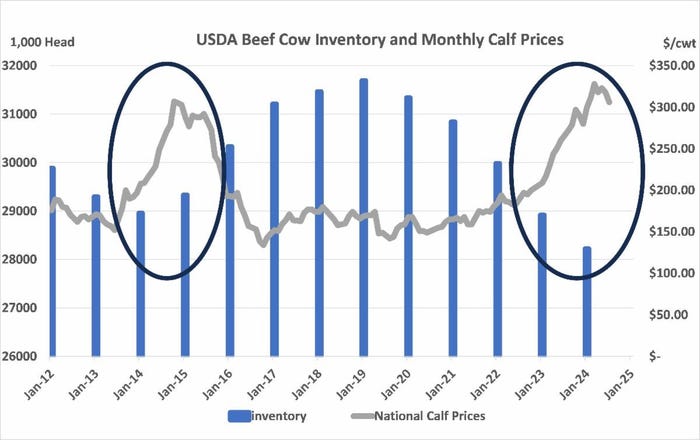

Related: USDA, USTR deliver over $26.7b in market access for U.S. agriculture

In terms of where we are in the cattle cycle today compared to in 2015, the price trends look similar as if we have already seen peak prices and are headed for lower prices. However, the difference to notice between 2024 and 2015 is inventory levels and the rate of expansion. In 2015, expansion had already started when prices were at the levels we are seeing today. There was no incentive for prices to climb back up after the typical dip in the fall. In the current market, we have not started seeing signs of stabilization, much less expansion, and have already hit record prices that we saw back in 2015. This indicates that while we are experiencing some seasonality this year, it is not expected that we are headed for a continuous low level of cattle prices.

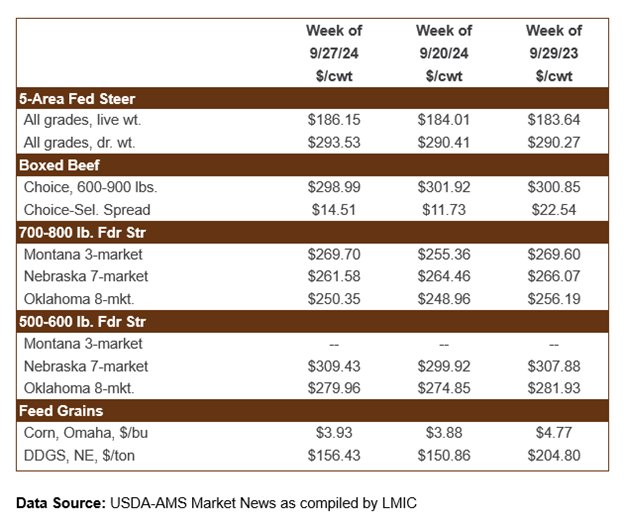

The Markets

Prices for feeder cattle are trending lower than a year ago, with some variability from week to week. The concern of onsetting drought impacts affecting forage availability in the southwestern part of the country in addition to inventory levels will potentially impact prices from declining as low as we would typically see this time of year. Feed grain prices are 1-4% higher than last week, but remain 18-24% lower than last year, allowing feedlots to continue holding cattle longer to increase fed weights. Average steer dressed weights reached 925 pounds as of September 1, almost 3% heavier than year ago levels and 4% higher than the historical average. The percentage of cattle grading choice has also increased by 3.5% since last year and by 2% compared to the 2018-2022 average.

Related: An update on beef cattle herd rebuilding