The evolution of U.S.-Mexican cattle and beef trade

Posted on September 9, 2024 by Derrell Peel

Source: Farm Progress. The original article is posted here.

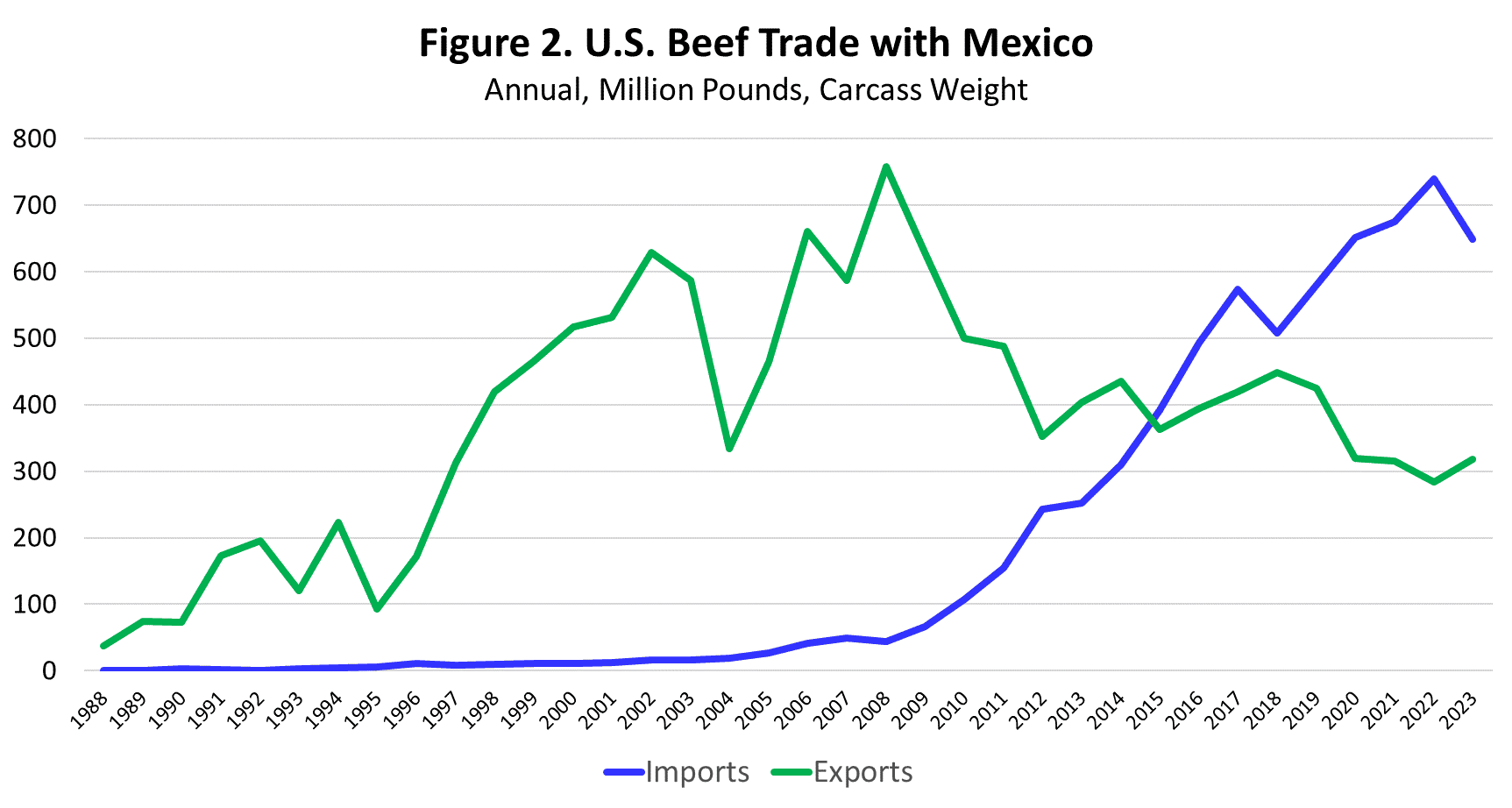

The next phase of beef industry trade between the U.S. and Mexico was the growth of beef exports to Mexico which began in the 1990s and accelerated sharply in the late part of the decade. By the late 1980s, Mexico was the third largest beef export market because there simply weren’t many export markets (Japan accounted for 70 percent of total exports.) Mexico was roughly six percent of total U.S. beef exports at that time. Growing rapidly after 1996, Mexico rose quickly to become the number two export destination and accounted for an average of 23.3 percent of exports from 2000-2003 (Figure 2).

Beef markets

After the BSE case in late 2003, Mexico was the only beef export market that did not close or greatly reduce. Mexico accounted for 72.4 percent of total beef exports in 2004 and averaged 59.4 percent of exports from 2004-2007. Mexico was the number one beef export market from 2004-2010 before other markets recovered. Mexico was the number two or three export market each year from 2011-2020 and averaged 15.0 percent of beef exports over the period. Recently Mexico dropped to the number 4 market with an average share of 9.2 percent of total exports from 2021-2023.

The economics that drove the increase in beef exports to Mexico in the 1990s and 2000s was largely a matter of supplementing deficit beef supplies in the country as consumption outpaced domestic beef production in the country. In other words, it was mostly a matter increasing the quantity of beef in Mexico.

The final phase that has been added to increasingly integrated U.S. and Mexican beef markets is Mexico’s emergence as a major global beef exporter. U.S. imports of beef from Mexico accelerated rapidly after 2009, with the country jumping to the number four place as a beef import source in 2010 (Figure 2). Mexican beef imports continued to grow with the country moving into the number three spot as a beef import source by 2017 and number two in 2021.

Boxed beef

The growth of beef exports from Mexico is largely the result of the Mexican beef industry switching from carcass-based beef markets to boxed beef technology in the 2000s. Adoption of boxed beef was a huge change in beef markets in Mexico that opened up much more value as specific products could be targeted to specific markets, including export markets. Mexico has also seen significant growth in cattle feeding and packing infrastructure in the past two decades. Mexico is now a major beef export market and beef import source for the U.S. meaning that trade has evolved from one-way flow of beef to bilateral trade of diverse products, which adds value in both markets.

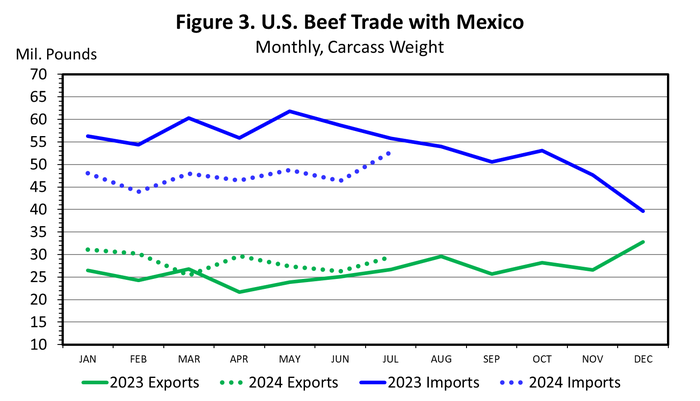

Figure 3 shows beef trade with Mexico in recent months. Mexico has been anomaly among U.S. beef trade markets in 2024 with exports increasing, despite decreasing exports to most other markets, and decreasing imports from Mexico, despite increasing imports from other major import sources. Numerous factors are no doubt contributing to current beef trade with Mexico, including Mexican macroeconomic conditions and domestic beef market conditions, along with a Mexican Peso that strengthened against the dollar from 2022 through 2023 before weakening recently.

.jpg?disable=upscale&width=1200&height=630&fit=crop)